Welcome to Hosteliest, your trusted source for all things Hotels and Travel. Today, we delve into an unexplored topic: H&R Block for Travel Nurses. A must-read for travel nurses seeking savvy financial solutions on the road.

Title: The Ultimate Guide to H&R Block for Travel Nurses

Travel nursing is a unique, adventurous, and rewarding career. But dealing with taxes can be challenging, especially if you work in different states throughout the year. That’s where H&R Block comes in; this tax service provider has become a beacon of hope for travel nurses across the country. In this article, we’ll reveal everything you need to know about using H&R Block for travel nurses.

The Need for H&R Block for Travel Nurses

As a travel nurse, you’re likely aware that your tax situation is a bit more complicated than average. You’ve probably wondered how to file multiple state income taxes, account for housing stipends, or manage tax home rules. These complexities make H&R Block an effective solution as it offers professional expertise navigating these challenges.

How does H&R Block Work?

H&R Block is primarily a tax preparation service that provides online resources, office visits, and software for DIY tax preparation. They specialize in catering to unique tax situations like those of travel nurses. This makes H&R Block for travel nurses an excellent option, as they understand how to handle multi-state filings, per diem rates, untaxed reimbursements, and other complex aspects of a travel nurse’s income.

Benefits of Using H&R Block

There are several benefits to using H&R Block for travel nurses. For one, they have extensive experience with multi-state tax filings – invaluable for travel nurses who have worked in multiple locations throughout the year. Their professionals understand the specifics of travel nurse taxation, such as tax-free stipends and reimbursements, which can help maximize your return or minimize what you owe.

Here are some additional key benefits of using H&R Block:

– Expert Guidance: H&R Block’s tax professionals provide personalized advice tailored to your unique tax situation.

– Convenience: With office locations nationwide and online services, getting your taxes done is convenient no matter where you are.

– Accuracy Guarantee: H&R Block stands by the accuracy of their work, so you can file with confidence.

Is H&R Block Right for Every Travel Nurse?

While H&R Block offers an effective solution for many, one size does not fit all. Your choice will likely depend on your comfort level with filing your taxes and the complexity of your situation.

For travel nurses comfortable with handling their taxes and have relatively straightforward tax situations, a DIY approach may work well. But if your tax situation is complicated or you prefer the peace of mind that comes having a professional handle your taxes, using H&R Block for travel nurses could be a wise decision.

Conclusion

In sum, H&R Block can be a viable option in meeting the unique tax needs of travel nurses. They offer professional, personalized advice, convenience, and a high degree of accuracy. We hope this article has provided valuable insights into using H&R Block for travel nurses.

Remember, every financial situation is different, so it’s essential to seek the appropriate advice tailored to your personal circumstances. While H&R Block is one solution, there may be other tax strategies more suited to your individual needs.

Navigating taxes as a travel nurse might seem daunting, but with the right guidance, it doesn’t have to be. With H&R Block, you can confidently navigate your unique tax situation and ensure you’re fulfilling your obligations accurately and effectively.

Table of Contents

ToggleMaximizing Your Financial Benefits: A Comprehensive Guide to H&R Block for Travel Nurses

Travel nursing can be an exciting venture, but managing finances during your travels can sometimes become overwhelming. Hence, it’s important to understand how to benefit from services like H&R Block that can help you maximize your financial benefits.

H&R Block is a well-established tax preparation company that can assist travel nurses in navigating through complex tax issues. They have a number of services designed specifically to cater to the unique needs of travelers, especially nurses.

One primary way to reap the full financial benefits as a travel nurse is by making the most of the various deductions allowed by the IRS. H&R Block has professional consultants who can guide you through this process. They can help identify potential deductible expenses such as travel, lodging, meal allowances, and even license and certification costs that you may not be aware of.

H&R Block’s digital tax preparation services are also invaluable for travel nurses. Their online portal allows you to handle your tax returns no matter where you may be located. This is especially beneficial for travel nurses who are always on the move.

Having a solid understanding of your state residency status is crucial as it can significantly affect your tax liabilities. H&R Block can clarify the tricky rules surrounding this topic and help you avoid costly mistakes.

Let’s not forget about retirement planning. As a travel nurse, you’re likely to be an independent contractor which means you’ll need to manage your retirement savings plan. H&R Block offers financial advice and tools that can assist you in setting up and managing your retirement funds.

Lastly, remember that being a travel nurse doesn’t mean you have to manage your finances alone. Companies like H&R Block exist to ease the burden of financial management, so you can focus on what you do best – providing critical health care services and exploring the world at the same time.

Understanding the Basics of H&R Block for Travel Nurses

H&R Block, a leading tax preparation company, offers a range of tailor-made services to meet the specific needs of different professions, including travel nurses. Primarily, this service understands the complexities of tax obligations and deductions for traveling healthcare professionals. H&R Block assists travel nurses in navigating these complexities and ensuring they meet all their tax obligations while also taking full advantage of the potential deductions available to them. The professionals at H&R Block are well-versed in the intricate nature of taxes for traveling nurses and can provide comprehensive guidance tailored specifically to their circumstances.

Advantages of Using H&R Block Services for Travel Nurses

There are numerous benefits to utilizing H&R Block’s services as a travel nurse. First and foremost, their vast understanding of the tax laws pertinent to this profession means that they can help prevent costly mistakes and overlooks. Travel nurses often qualify for a range of profession-specific deductions, and H&R Block can ensure they take full advantage of these. In addition, their services are especially useful for those who work in multiple states throughout the year, which can make tax time particularly complex. With H&R Block, travel nurses can rest easy knowing their taxes are being handled by experts.

Tips for Maximizing H&R Block Services for Travel Nurses

In order to maximize the benefits of H&R Block’s services, travel nurses should keep detailed records of their work-related expenses. This includes things like travel costs, uniform expenses, and any necessary continuing education or certifications. Providing this information to your tax professional can ensure that you claim the maximum amount of deductions possible. Additionally, it’s advisable to schedule a consultation with an H&R Block tax professional at the start of each tax year to discuss any changes in the tax code that might affect your return. Regular communication with your tax professional can help ensure you are always in the best position come tax time.

Frequently Asked Questions (FAQ)

“What are the specific tax considerations for travel nurses using H&R Block?”

Travel nursing is a unique profession, offering various tax perks due to the traveling aspect. When using H&R Block for filing taxes, there are several specific tax considerations for travel nurses:

1. Tax Home: The IRS allows travel nurses to claim deductions for their living expenses on the road only if they have a permanent tax home. This home doesn’t have to be a physical structure, but rather any location where they regularly conduct business.

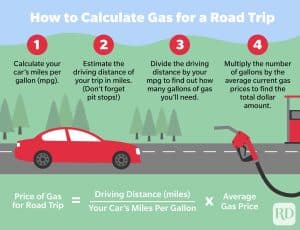

2. Travel Expenses: Travel nurses can typically write off their expenses related to transportation, meals, and lodging while on assignment. These include airfare or mileage, hotel stays, rental apartments, and even meal expenses. However, the tax reform of 2018 has restricted some of these deductions for W-2 employees.

3. Per Diem Rates: Travel nurses often receive per diem allowances for incidental expenses. While this allowance is generally not taxable, it’s crucial to maintain meticulous records to prove the money was used as intended.

4. State Taxes: If a travel nurse works in several states, they may be required to file a tax return in each state. This can be a complex process and may require additional support.

5. Professional Expenses: A travel nurse can often deduct the costs of necessary job-related equipment, professional dues, license fees, and uniforms that aren’t suitable for everyday wear.

6. Professional Help: It’s beneficial to hire a tax professional, like H&R Block, who understands the nuances of travel nurse taxation. They can help maximize deductions and ensure compliance with all relevant tax laws.

Remember, tax laws are complex and subject to change. Always consult with a professional for accurate information.

“How can H&R Block assist travel nurses with their unique tax situations, especially when staying in hotels for extended periods?”

H&R Block can provide invaluable assistance to travel nurses dealing with unique tax situations. Being professionals who often stay in hotels for extended periods, their tax scenarios can be complicated by differing state tax laws, per diem allowances, and travel expense deductions.

Firstly, H&R Block’s team of tax professionals are well versed in the complexities of state tax laws. Since travel nurses often work across multiple states, they may be subject to varying tax rates. H&R Block can help understand each state’s laws and ensure you’re accurately reporting income and paying the correct amount of tax.

When it comes to per diem allowances, which are daily allowances given to cover living expenses while traveling, H&R Block can assist travel nurses in understanding how these allowances impact their taxable income. These allowances may or may not be fully taxable depending on the individual’s circumstances.

Also, travel nurses often have a significant amount of out-of-pocket travel-related expenses. H&R Block can guide these healthcare professionals in identifying which of their expenses can be legitimately claimed as deductions on their tax returns. They can help determine if hotel costs, transportation expenses, meal costs, and even certain job-related expenditures, can be deducted. These deductions can significantly reduce your taxable income, saving you money.

In essence, H&R Block provides tailored tax advice and preparation services that can help travel nurses navigate through their unique tax situations. Their aim is to ensure every travel nurse is correctly adhering to multi-state tax laws, making the most of available deductions, and not overpaying taxes. Therefore, using H&R Block’s services can make the daunting task of tax preparation much more manageable for travel nurses.

“Can travel nurses benefit from using H&R Block for their tax preparations, particularly concerning claims for hotel stays and travel expenses?”

Absolutely, travel nurses can benefit significantly from using H&R Block for their tax preparations.

When it comes to filing taxes, the process can get complex and overwhelming. Being a travel nurse, who usually incurs frequent lodging and travel expenses, only adds to the intricacy. This is where a professional tax service like H&R Block can come in handy.

H&R Block has expert tax professionals who are familiar with the specific tax rules that apply to travel nurses, including deductions for hotel stays and travel expenses. They can help you understand what deductions you’re eligible for and how to claim them properly.

Hotel stays, which are often an integral part of a travel nurse’s journey, can be deducted as travel expenses. Travel expenses could also include transportation costs, such as airfare or car rental fees, and meals consumed while traveling, all of which are relevant to travel nurses.

Remember, though, that to claim these deductions, you must keep thorough records of your expenses. Here again, H&R Block can assist with educating you on the best practices of keeping track of your expenses, ensuring maximum deduction and accurate filing.

So, not only can H&R Block provide reliable tax preparation services, but they can also offer valuable guidance to travel nurses on how to manage their unique tax situations effectively.

In conclusion, the service offered by H&R Block to travel nurses is an excellent tool to ensure that tax-related aspects of their profession are adequately handled. By leveraging the unique taxation rules related to travel and accommodation expenses, travel nurses can potentially save a significant amount of money. Therefore, whether you’re new to the travel nursing profession or an experienced hand, considering the services of such a specialist could be hugely beneficial in the long run.

Traveling and staying at hotels can be a significant outlay for those in this profession, but with H&R Block’s assistance, you can gain peace of mind knowing that all tax deductions related to these costs are taken care of. In the ever-evolving world of travel and hotel accommodations, it’s always great to have an adept hand guiding your financial decisions.

Travel Nurses, make sure to explore what H&R Block has to offer you! The road might be long and winding, but with proper tax management, your journey can become a lot smoother. Safe travels!